Holiday Pay in the Philippines: A Comprehensive Computation Guide

Holiday pay is a key benefit for employees in the Philippines. The government mandates it to ensure workers receive fair compensation for time off during specific holidays. This article provides a comprehensive guide to calculating holiday pay and understanding its role in payroll processes, helping employees verify their earnings for the year’s remaining holidays.

- What is Holiday Pay?

- What Are the Holidays Covered?

- What is the Significance of Holiday Pay?

- Who Is Eligible for Holiday Pay?

- How to Compute Holiday Pay?

- Frequently Asked Questions

Holiday Pay in the Philippines

Holiday pay in the Philippines refers to the additional compensation that employees are entitled to receive for regular holidays, regardless of whether they work on those days or not.

This benefit is a legal requirement under Philippine labor laws, ensuring that employees are fairly compensated during nationally recognized holidays. It is governed by the Labor Code of the Philippines, along with supplementary regulations issued by the Department of Labor and Employment (DOLE), which outline the specific rules and entitlements for both working and non-working employees on these holidays.

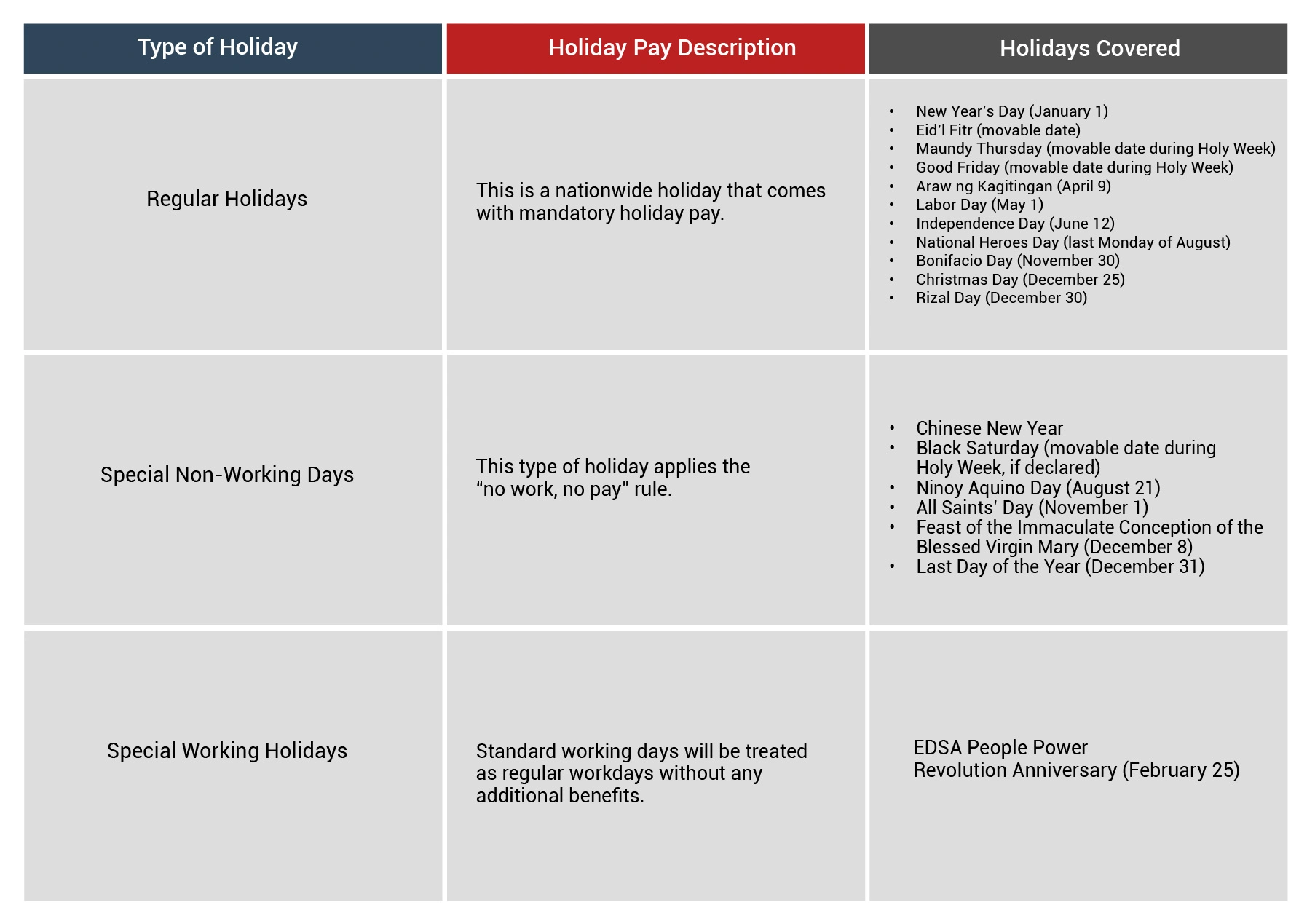

Holidays Covered

The Philippines observes several types of holidays. Here’s a quick guide to understanding the different categories:

Significance of Holiday Pay

The significance of holiday pay lies in its vital role in enhancing employee welfare, ensuring fair compensation, and promoting a healthy work-life balance. Below are key points that emphasize its importance:

- Fair Compensation. Holiday pay guarantees that employees are adequately rewarded for their time, particularly when they are required to work on days typically set aside for rest, family, and celebration.

- Employee Welfare. Providing additional pay or paid time off during holidays acknowledges the value of employees’ contributions and supports their financial well-being.

- Work-Life Balance. Holiday pay enables employees to take time off and fully enjoy holidays without the stress of lost income, fostering a healthier and more sustainable balance between work and personal life.

- Motivation and Morale. Providing holiday pay enhances employee morale and motivation by showing that the company appreciates their contributions and acknowledges the importance of rest and celebration.

- Legal Compliance. Offering holiday pay helps employers adhere to labor laws, minimizing the risk of disputes or penalties and strengthening trust and goodwill with employees.

Who Is Qualified for a Holiday Pay?

Employees are eligible for holiday pay based on the following conditions:

For Regular Holidays:

- All employees are entitled to holiday pay, regardless of whether they work on the holiday.

- The only exception is part-time workers who are not scheduled to work on the holiday.

For Special Non-Working Holidays:

- Employees must work on the scheduled workday immediately before the holiday to qualify.

- If an employee is absent on that day, they lose their eligibility for holiday pay unless the absence is covered by an approved leave.

Exclusions:

The following groups are not eligible for holiday pay unless stated otherwise in their contracts:

- Managerial employees

- Government employees

- Workers paid on a commission basis

- Freelancers

For Special Working Holidays:

- Employees who work on these days are not entitled to extra holiday pay. Their pay is treated as regular daily wages unless their employer’s policy explicitly provides otherwise.

- These days are handled differently from both regular holidays and special non-working holidays.

Related Read: Official List of Philippine National Holidays

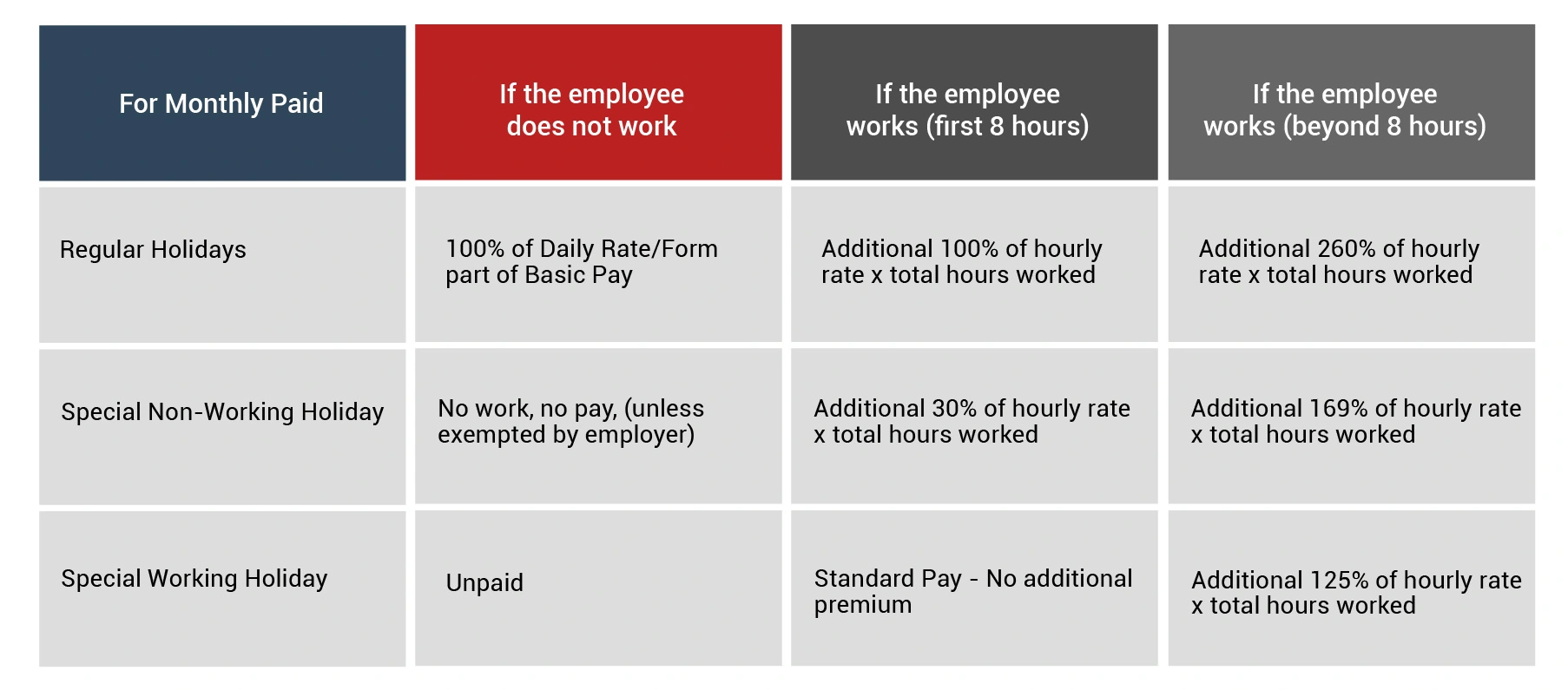

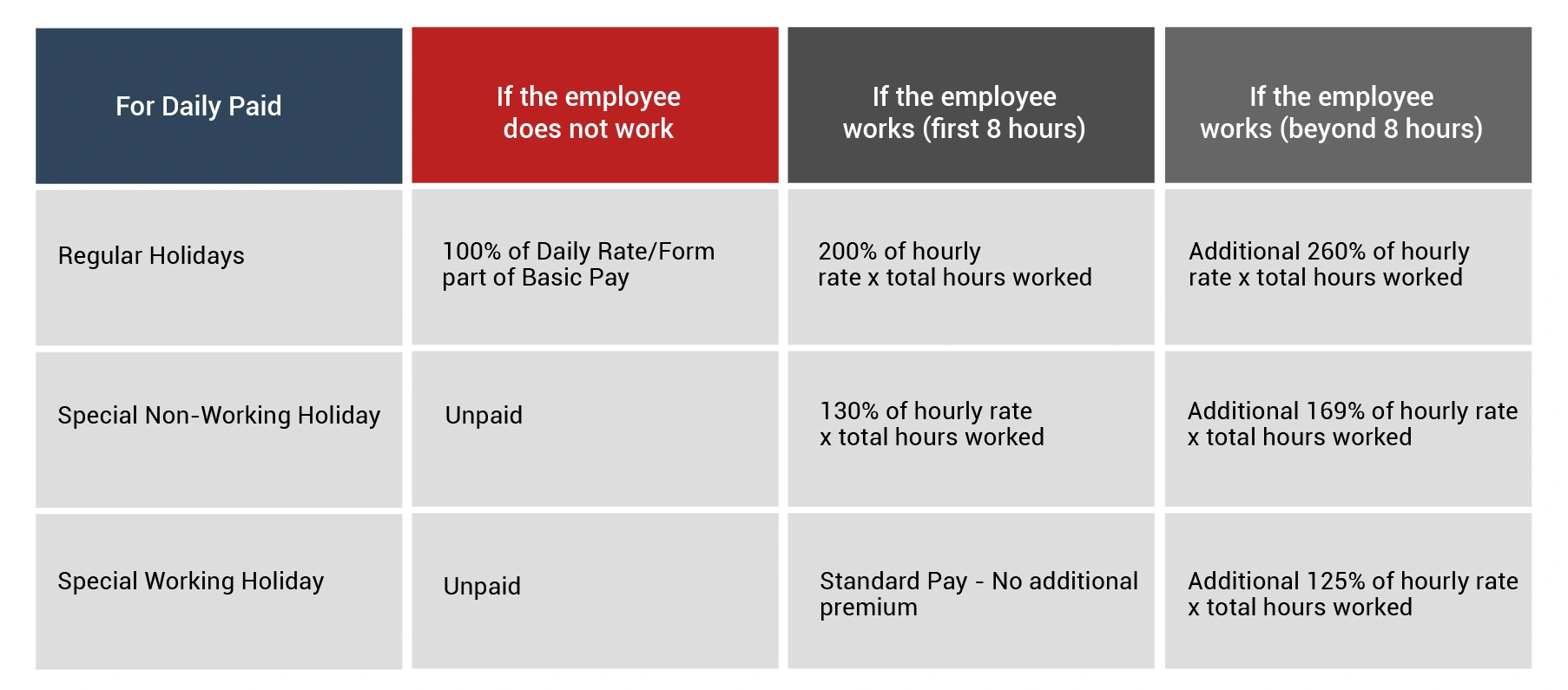

Holiday Pay Computations

Holiday pay calculation varies depending on the type of holiday. Below are the relevant formulas and practical examples to guide you:

*Note that calculations may differ depending on whether you are paid on a monthly or daily basis.

Let Us Guide Your Company Streamline Salary Computations

Frequently Asked Questions

What happens if a holiday falls on an employee’s rest day?

If a Regular Holiday falls on a rest day and the employee does NOT work, they are still entitled to 100% of their daily rate. If they work, the pay increases to 260% of the regular rate (200% × 130%).

Do probationary employees qualify for holiday pay?

Yes, probationary employees are entitled to holiday pay.

Is holiday pay taxable?

Yes, holiday pay is considered part of an employee’s gross income and is subject to tax.