A Comprehensive Guide to Bookkeeping in the Philippines

Bookkeeping is the foundation of a successful business, ensuring you can track financial health, make informed decisions, and meet legal responsibilities. For businesses in the Philippines, it is vital to comply with Bureau of Internal Revenue (BIR) regulations and avoid penalties.

This guide covers key aspects of bookkeeping in the Philippines, from legal compliance to creating efficient systems, helping you stay organized and optimize your financial processes.

- What is Bookkeeping?

- What are The Types of Books of Accounts Recognized by the BIR?

- What are the Main Responsibilities of Bookkeeping?

- What is the Importance of Bookkeeping?

- Frequently Asked Questions on Bookkeeping in the Philippines

What is Bookkeeping?

Bookkeeping, whether managed in-house or through outsourced services, is the systematic process of recording, organizing, and maintaining a business’s financial transactions to ensure accuracy, consistency, and adherence to financial regulations. It functions as the cornerstone of financial management, providing a comprehensive and detailed overview of revenue sources, expenditure patterns, and the overall flow of funds within the organization.

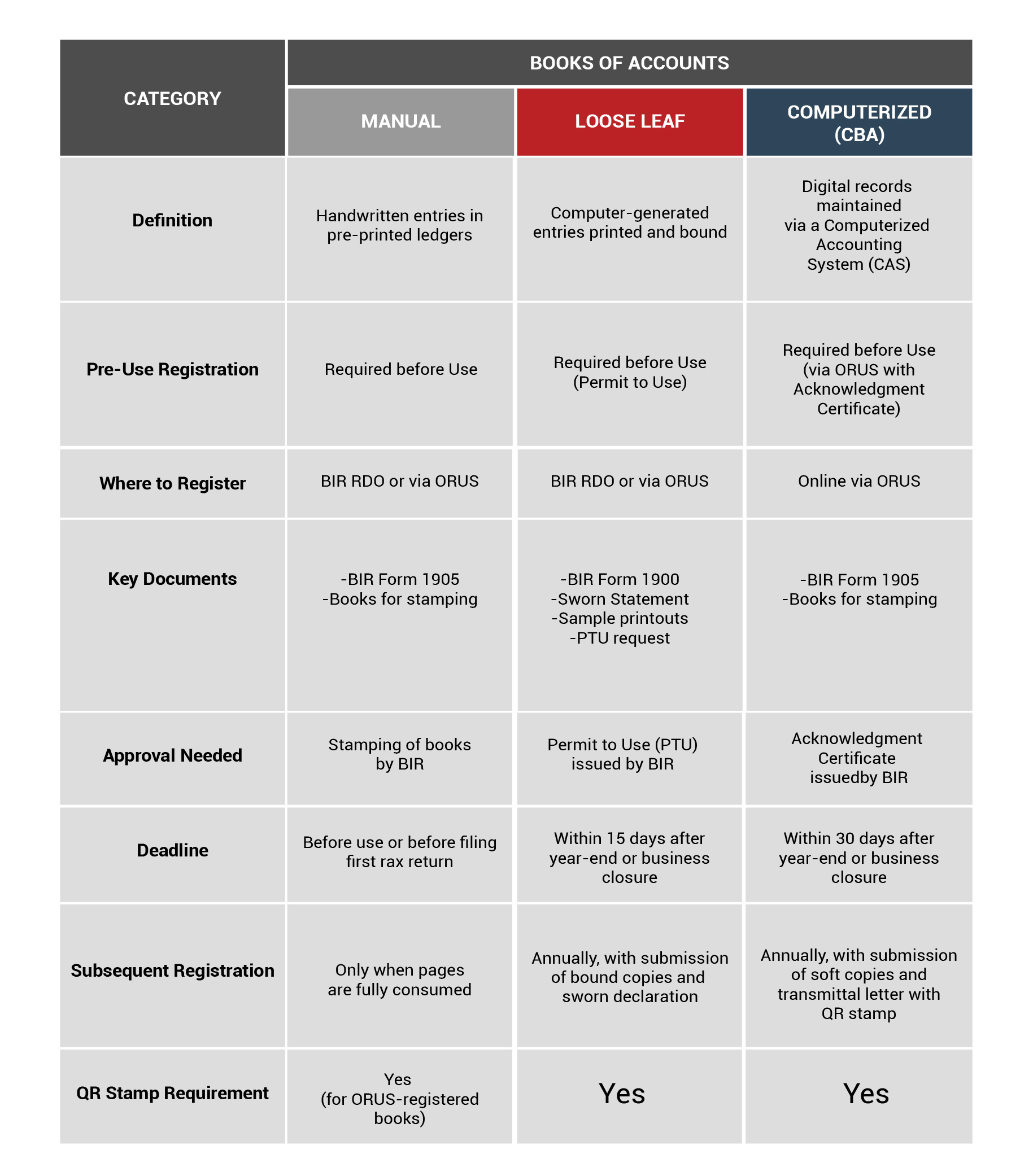

What are The Types of Books of Accounts Recognized by the BIR?

In the Philippines, businesses are required by the Bureau of Internal Revenue (BIR) to maintain specific books of accounts for bookkeeping. These records are crucial for ensuring tax compliance and accurate financial management. Below are some of the books you can maintain for bookkeeping:

What are the Main Responsibilities of Bookkeeping?

The primary responsibilities of bookkeeping involve maintaining accurate and up-to-date financial records, which are essential for the smooth operation and financial well-being of any business.

By systematically tracking and organizing financial data, bookkeeping ensures transparency, aids in decision-making, and supports compliance with tax and regulatory requirements. These responsibilities include:

- Recording Transactions. Logging every sale, purchase, payment, and receipt to maintain a complete financial history.

- Organizing Financial Data. Categorizing expenses and income for streamlined tracking and analysis.

- Bank Reconciliation. Ensuring consistency by matching financial records with bank statements.

- Managing Accounts. Monitoring accounts payable (bills) and receivable (invoices) to maintain cash flow.

- Generating Reports. Preparing critical financial documents like income statements, balance sheets, and cash flow statements.

What is the Importance of Bookkeeping?

Bookkeeping is more than just recording numbers; it is a fundamental process that supports the financial health and success of any business. By ensuring every transaction is accurately documented and organized, bookkeeping lays the groundwork for effective financial management. It plays a key role in:

- Legal Compliance. Businesses in the Philippines are required to adhere to tax regulations set by the Bureau of Internal Revenue (BIR). Accurate bookkeeping ensures readiness for audits and smooth tax reporting.

- Financial Analysis. Well-maintained records empower business owners to evaluate performance, identify trends, and make data-driven decisions.

- Securing Loans and Investments. Lenders and investors rely on precise financial data to assess a business’s credibility and potential before committing funds.

- Avoiding Penalties. Proper bookkeeping minimizes the risk of errors, helping businesses avoid costly fines and penalties from the BIR.

Let Us Assist You with Your Bookkeeping Needs

Frequently Asked Questions

What are the legal bookkeeping requirements for businesses in the Philippines?

All businesses are required to register and maintain their books of accounts with the BIR. These records, including the General Ledger, Journal, Sales Book, and Purchase Book, must be kept for at least five years to comply with tax filing regulations. Furthermore, in cases of pending audits, protests, or refund claims, the books must be retained until the matter is fully resolved, even if it surpasses the five-year retention period.

What penalties can I face for poor bookkeeping practices?

Maintaining properly registered books of accounts is a fundamental responsibility for all businesses. Compliance with these requirements not only ensures adherence to legal standards but also protects your business from significant financial and legal repercussions. Below is a summary of the key penalties for non-compliance:

- Failure to Register Books of Accounts. Penalty of ₱1,000 per violation, up to a maximum of ₱25,000 annually, as mandated by Section 250 of the Tax Code.

- Failure to Retain Books for the Required Period. Penalties include fines ranging from ₱5,000 to ₱10,000 and/or imprisonment for one to two years.

- Failure to Present Books During Official Audits. Subject to the same penalties as record-keeping violations, and may also result in the denial of deductions or input VAT claims.

- Penalties for Micro and Small Taxpayers. Failure to file required returns or reports incurs a reduced penalty of ₱500 per violation, capped at ₱12,500 annually.

- Willful Refusal to Provide Books or Records. Penalties include fines ranging from ₱50,000 to ₱100,000 and imprisonment for two to five years.

What are common bookkeeping challenges in the Philippines, and how do I overcome them?

Challenges like complex tax rules, limited expertise, and time constraints can be tackled by:

- Hiring a professional or using bookkeeping software.

- Automating tasks such as invoicing and expense tracking.

- Consulting tax experts or joining bookkeeping workshops.