The Essential Guide to Philippine Labor: Recruitment & Payroll

Navigating employment in the Philippines requires clear understanding of local rules and cultural norms. This guide gives employers and HR a practical overview of recruitment and payroll to manage their workforce with confidence and clarity.

- Basic Employment Framework

- Recruitment Best Practices

- Payroll Fundamentals

- Mandatory Contributions

- Philippine Holidays

- Frequently Asked Questions

Basic Employment Framework

Before you begin recruiting, it’s essential to understand the fundamentals of the employment framework and how they shape your hiring decisions.

Employment Classifications

Employees are commonly classified by the nature and duration of their work:

- Regular. Hired for duties that are necessary or desirable to the employer’s usual business.

- Probationary. New hires on a testing period (typically up to six months) to assess fitness for regular employment; they enjoy the same rights as regular employees during this time.

- Project-based. Engaged for a specific project or undertaking, with employment tied to the project’s scope and completion.

- Seasonal. Employed for work performed only during particular times of the year.

- Fixed-term. Contracted for a defined period with a predetermined end date.

Standard Working Conditions

- Work hours. The standard workday is eight hours.

- Rest periods. Employees are entitled to a meal break of at least 60 minutes (generally unpaid) and one full day rest within a week

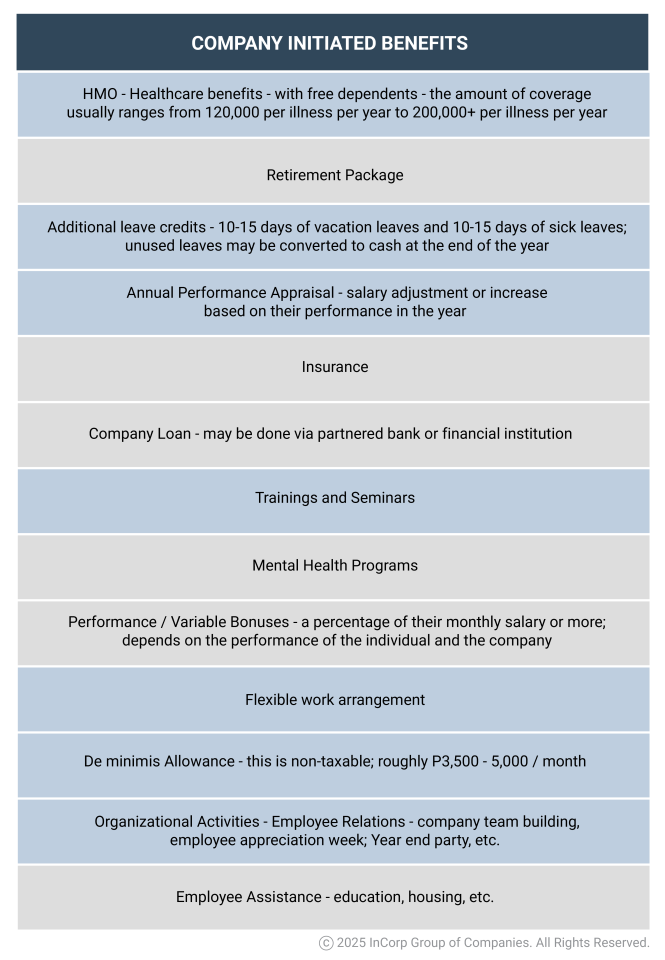

- Common benefits. The following are the mandatory and company initiated befits in the Philippines. Those highlighted are widely offered:

Recruitment Best Practices

Compliant Job Postings

- Center on role requirements: skills, qualifications, responsibilities, and performance expectations.

- Use neutral, inclusive language; reference essential functions and any legitimate physical or schedule requirements.

Interviews

- Focus questions on job performance, competencies, and past work behaviors.

- Provide clear information about the role, team, culture, expectations, and next steps.

- Exclude questions unrelated to job requirements or protected characteristics.

Background Checks

- Obtain explicit, informed consent before initiating checks.

- Limit checks to relevant scopes (e.g., employment history, education, professional licenses, references) and apply them consistently across comparable roles.

- Comply with local laws on timing, adverse action, and data privacy.

Standard Offer Letter Components

- A clear and comprehensive job offer typically includes:

- Position title

- Employment status (e.g., Regular, Probationary)

- Start date

- Compensation and benefits summary

- Work schedule and location (or remote/hybrid terms)

- Immediate supervisor

- Conditions and contingencies (e.g., background check completion, work authorization)

- Response deadline and point of contact

Payroll Fundamentals

Accurate and timely payroll fosters employee trust, supports compliance, and minimizes rework. Establish clear payroll policies for timekeeping, pay cycles, earnings and deductions, and documentation so employees understand how their pay is calculated and when they will be paid.

Timekeeping: Maintain accurate time records, including start and end times, breaks, and total hours, to correctly calculate regular pay, overtime, and any applicable differentials.

Allowances: These are payments for specific purposes, such as transportation or meals. It’s important to distinguish between taxable and non-taxable allowances.

Compensation Add-ons

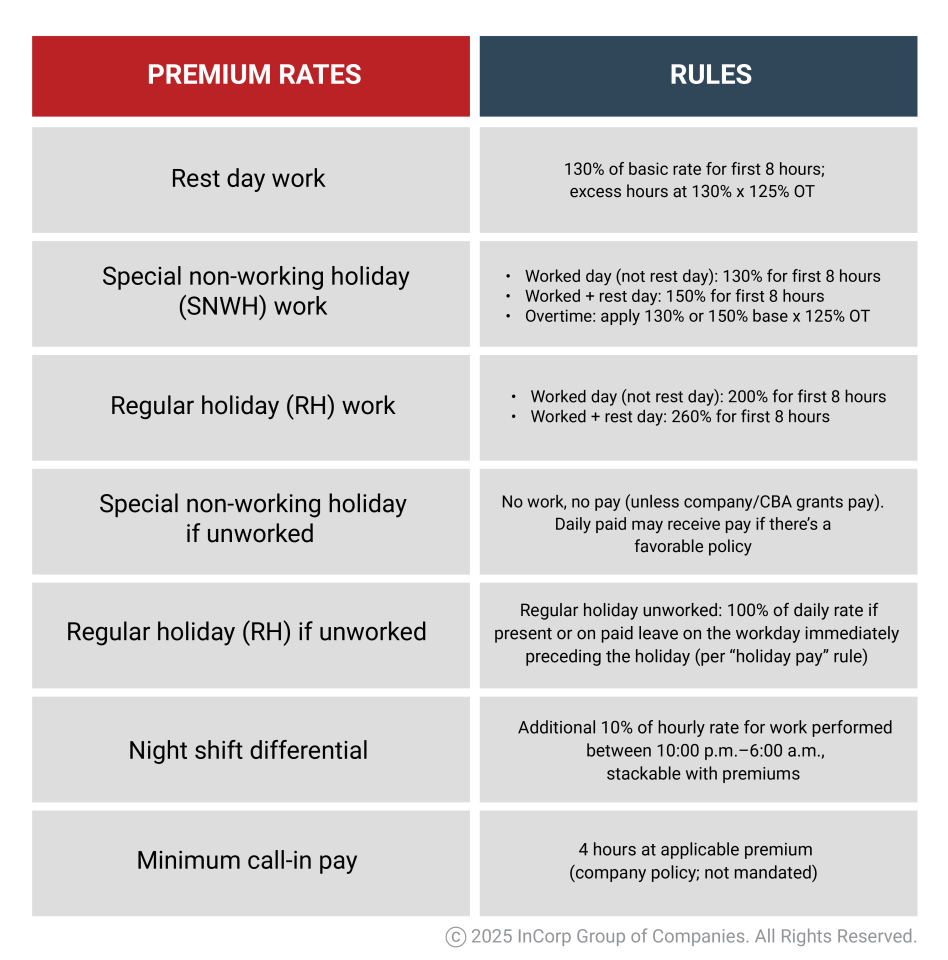

Beyond base salary, some roles and schedules qualify for additional pay to recognize extended or less conventional work hours. Below are the following:

- Overtime pay. Premium pay for hours beyond eight in a day; define eligibility, approvals, and timekeeping. Clarify daily vs. weekly calculations.

- Night differential. Premium for designated night hours; specify covered hours, rates, and stacking rules with other premiums.

- Rest day/holiday premiums. Provide extra pay for work performed on rest days or recognized holidays and publish the official holiday calendar with clear substitution rules. Below is the table for rest day and holiday premiums.

- Leave Entitlements. The minimum requirement is the 5-day Service Incentive Leave, which employees may avail only after completing one year of service. However, for retention purposes, most companies offer leave benefits beyond the statutory minimum. The table of benefits above outlines the types of leaves commonly provided.

Mandatory Contributions

Both employers and employees must contribute to government social programs that provide financial security and healthcare coverage. Employers are also responsible for withholding and remitting employee income taxes.

Understanding these obligations helps ensure compliance, accurate payroll, and uninterrupted access to benefits.

- Social Security System (SSS). Provides benefits for sickness, maternity, disability, retirement, and death.

- Philippine Health Insurance Corporation (PhilHealth). National health insurance that helps cover healthcare costs. While its coverage is minimal and primarily reduces the total hospital bill, most companies offer additional health insurance (HMO) to provide more comprehensive benefits, including outpatient and laboratory services.

- Home Development Mutual Fund (Pag-IBIG Fund). Offers housing loans, multi-purpose loans, and savings programs.

- Withholding tax. Employers must withhold and remit the appropriate income tax from employees’ salaries to the Bureau of Internal Revenue (BIR).

**Note: The employer deducts the employee’s share via payroll and remits it to the respective agencies along with the employer’s share, following prescribed schedules and reporting requirements.

Types of Holiday

The Philippines observes several categories of holidays, each with distinct pay and scheduling rules. Clearly identifying the holiday type in your policy and calendar helps ensure correct payroll treatment, consistent scheduling, and compliance with DOLE guidance.

- Regular holidays. Paid even if no work is performed; work performed is typically paid at 200% of the daily rate (plus applicable overtime/night differential).

- Special (non-working) holidays. “No work, no pay” generally applies unless company policy or a CBA provides otherwise. Work performed is paid with a premium (commonly 130%, per DOLE rules).

- Special working days. Treated like ordinary working days unless company policy grants a premium. Declared via presidential proclamation and may vary yearly.

- Regional/local holidays. Apply to specific LGUs based on local proclamations; follow DOLE guidance for compensation. Examples include city/provincial foundation days or local fiestas.

Allow Us to Help You with Your Recruitment and Payroll

Frequently Asked Questions

How long can a probationary period last, and what should be set at the start?

Typically up to six months. Employers should define reasonable standards of performance in writing at the start and assess the employee against those standards.

How is overtime, night differential, and rest day/holiday pay handled?

Overtime applies beyond 8 hours/day at statutory multipliers. Night differential adds 10% for work between 10:00 p.m.–6:00 a.m. Rest day/holiday work is paid with premiums per the holiday type and whether it’s a rest day.

Which mandatory contributions must be withheld and remitted?

SSS, PhilHealth, and Pag-IBIG contributions (employee share deducted via payroll plus employer share), and withholding tax to the BIR, all on prescribed schedules.

Are allowances taxable?

Allowances (e.g., transport, meal, communication) can be taxable or non-taxable depending on type and caps set by BIR rules. Define which allowances you offer, their amounts, and tax treatment in your policy.

When are employees entitled to regular holiday pay if unworked?

If present or on paid leave on the workday immediately preceding the holiday, daily-paid employees typically receive 100% of the daily rate for an unworked regular holiday.