Guidelines on the Pag-IBIG Fund’s Implementation of Increase in the Maximum Fund Salary (MFS) Effective February 2024

HDMF Circular No. 460 announces guidelines for the planned implementation of the increase in the Maximum Fund Salary (MFS) starting February 2024. Before the approval of the guidelines regarding the increase was signed off on June 13, 2023, by the Senior Management Committee (SMC), the Board of Trustees held a Regular Board Meeting on February 16, 2023.

The objectives of the guidelines are as follows:

- To encourage the culture of saving among Filipino workers

- To promote home ownership with the help of mobilizing funds for sustainable housing or financing

- To have a unified understanding and implementation of the increase in Pag-IBIG Monthly Membership Savings rates.

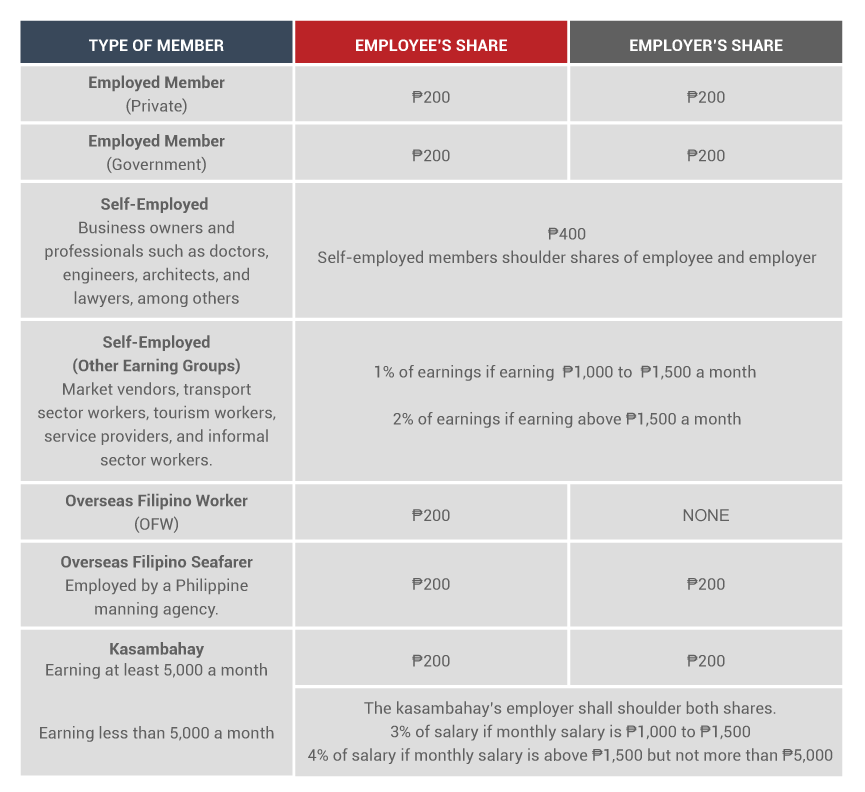

Pag-IBIG Monthly Savings Rates

The maximum fund salary to be used in computing the employee and employer savings has been increased from Five Thousand Pesos (P5,000.00) to Ten Thousand Pesos (P10,000) taking into consideration financial calculations and rates of benefits in accordance with Section 7 of Republic Act No. 9679.

What is the Coverage for Mandatory Members?

The monthly fund salary of the following members shall be covered unless stated below:

- All workers covered by the Social Security System (SSS) provided that actual SSS membership shall not be a condition precedent to the mandatory coverage in the Fund;

- Private workers, whether they are permanent, temporary, or provisional, who do not exceed the age of sixty (60);

- Filipino seafarers, after signing the standard contract of employment that exists between the manning agency and the seafarer, which, together with the foreign ship owner, acts as the employer;

- Self-employed individuals are subject to mandatory coverage, such as individuals who signed up for Fund coverage via HDMF Circular No. 96, will be regarded as the employer and employee, respectively, and shall subsequently be obliged to pay the employee’s portion as well as the employer counterpart based on the above-mentioned rates;

- All employees covered by the Government Service Insurance System (GSIS), irrespective of their appointment status, together with Constitutional and Judicial Commissions;

- Uniformed members of the Armed Forces of the Philippines, the Bureau of Fire Protection, the Bureau of Jail Management and Penology, and the Philippine National Police;

- Filipinos working for employers abroad, regardless of deployment either domestically, internationally, or both;

- Household workers or “Kasambahays” who fit the following definition:

- General Household Helper

- Yaya (Nanny)

- Cook

- Gardener

- Laundry Person

- Any person who regularly performs domestic work in one household on an occupational basis (live-out arrangement)

Confidently Implement the Changes of HDMF Contributions in Your Payroll

With the changes in the contribution rates of mandatory benefits, it is understandable to feel quite overwhelmed and wonder if you were able to apply the new rates correctly.

Our team of certified payroll professionals is ready to assist you with any payroll concerns you have or may encounter brought about by the recent adjustments in the mandatory contributions rates.

Efficiently Incorporate the Modified HDMF Contribution Rate

As adjustments with mandatory benefits are continuously being implemented, our Certified Payroll Professionals can help you ease the transition in your payroll computations.