SSS Releases Updated Contribution Schedule for 2025

The Social Security System released an advisory for the new schedule of contributions for Business Employers (ERs) and Employees (EEs) effective January 2025.

New SSS Rates Effective 2025

Under Republic Act (RA) 11199, the following increases effective 2025 are the following:

- Contribution rate to 15%

- Minimum Monthly Salary Credit (MSC) to ₱5,000.00

- Maximum MSC to ₱35,000.00

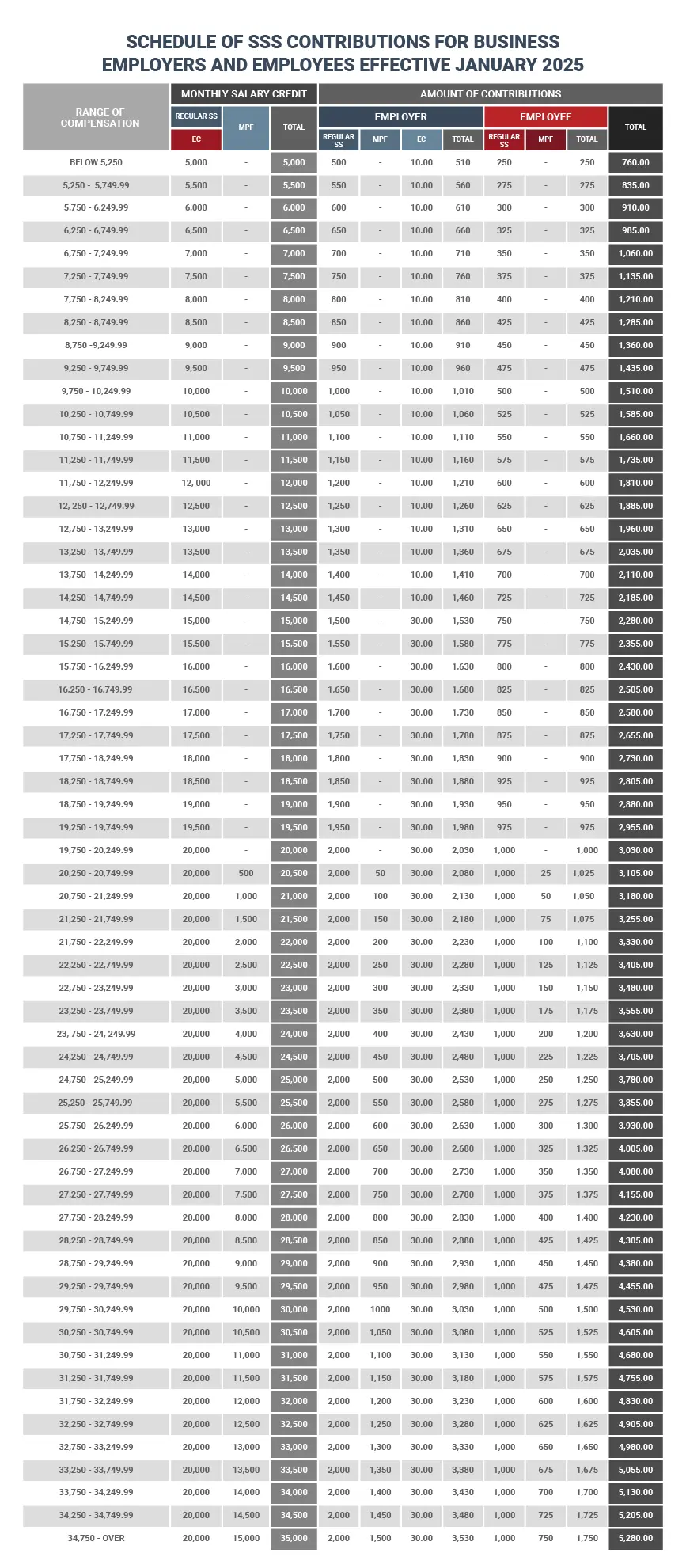

Schedule of SSS Contributions

The table below outlines the contributions of programs administered by the SSS:

- Regular Social Security (SS) Program

- Employees’ Compensation (EC) Program

- Mandatory Provident Fund (MPF) Program

Computation and Benefits

- Effectively, there are no changes in the computation of benefits primarily for maternity, sickness, retirement, disability (permanent total or partial), death, unemployment, and funeral under the Regular SS and EC programs since the maximum basis of MSC would still be at ₱20,000.

- Contributions for the MSC exceeding ₱20,000, up to a maximum of ₱35,000, will be allocated to the MPF Program and credited to the member’s individual account. Benefits under this program covering retirement, permanent total disability, and death will be based on the total accumulated account value, which includes all contributions plus net investment income.

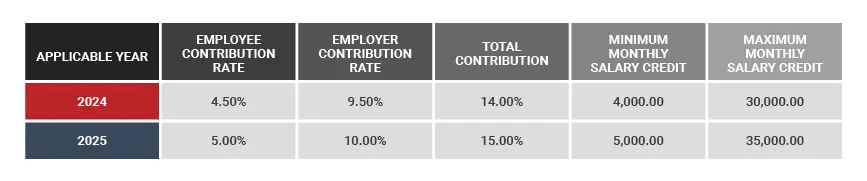

Comparison Between 2024 and 2025 SSS Contributions

The table below provides a detailed comparison of contributions for 2024 and 2025, highlighting any rate changes, monthly salary credits (MSC), or employer and employee shares. This comparison aims to understand better adjustments to the SSS contribution structure and their potential impact on members and employers.