A Comprehensive Guide to Tax Mapping for Foreign and Domestic Companies in the Philippines

As part of doing business in the Philippines, foreign and domestic firms in the Philippines must completely comply with current tax rules. Maintaining compliance with such rules will protect your company from penalties imposed by the Bureau of Internal Revenue (BIR) during tax mapping.

Tax mapping in the Philippines can be a difficult and time-consuming task. From documentary prerequisites to non-compliance penalties, we’ve compiled a list of everything you need to know to help you navigate the Philippine tax mapping process and ensure compliance.

What is Tax Mapping?

Tax mapping is a Tax Compliance Verification Drive (TCVD) program launched by the BIR in 2003 to broaden the tax base and improve tax compliance among enterprises in the country. The initiative allows the BIR’s approved examiners to visit companies and check their compliance with the current tax regulations.

Tax Mapping Coverage

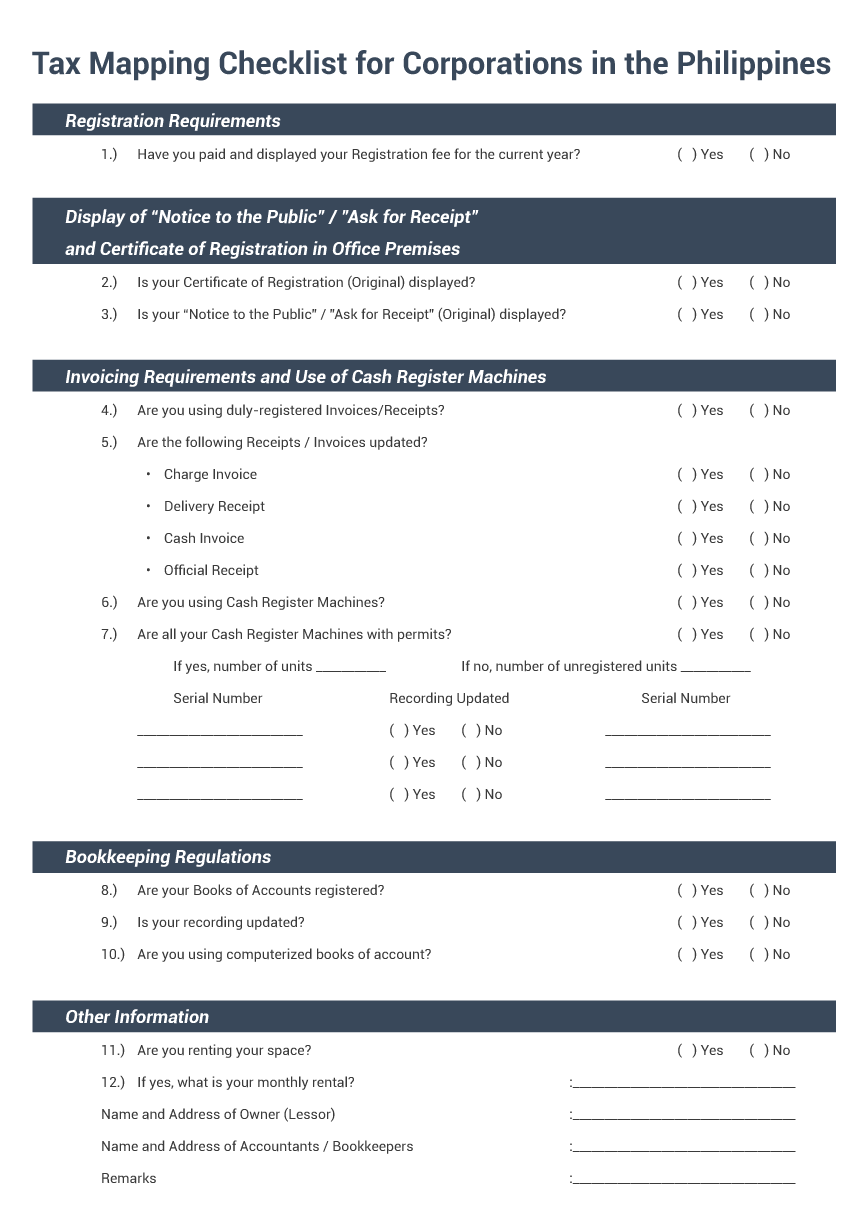

During the process of tax mapping, the BIR usually checks for the following documents:

- Taxpayer’s registration of head office and branches (BIR Form No. 2303) along with related updates thereto and posting the same in a conspicuous place

- Payment of the annual registration fee (BIR Form No. 0605) and posting the same in a conspicuous place

- Authority to print receipts and invoices, issuance of such receipts and invoices of every sale of services and goods, and contents of receipts and invoices under the rule on invoicing requirements

- Registration of cash register machines (CRM), point-of-sale (POS) machines, and computerized accounting system (CAS)

- Display of registration notices and other related requirements

- Registration of books of accounts in the Philippines to manual and simplified books or BIR approval on loose-leaf books of accounts and compliance with bookkeeping regulations

If you are having difficulty remembering the documentary prerequisites, you may use this checklist as a guide to avoid overlooking important information during the tax mapping process:

The tax mapping process is merely to verify that all enterprises in the Philippines adhere to the most recent tax legislation.

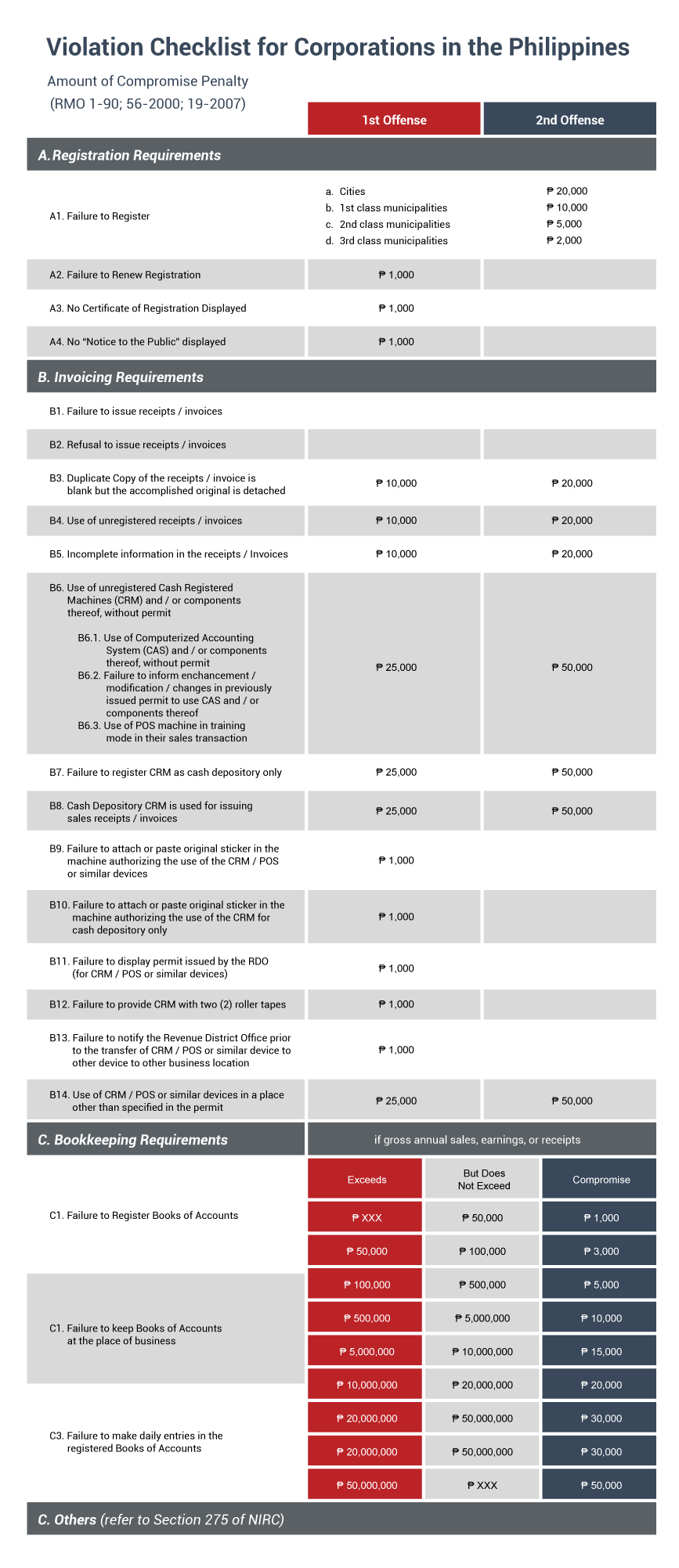

Penalties for Tax Mapping Violations

Establishments that did not comply with the tax mapping requirements will be subjected to penalties or fees sanctioned by the BIR. Therefore, It is important that you carry out proper bookkeeping of your documents to ensure that all your files are complete. Below are the penalties for certain tax mapping infractions under the National Internal Revenue Code (NIRC).

Streamline Your Tax Mapping Preparation for Your Business in the Philippines

It is imperative to keep your company compliant with the current tax requirements. Knowing when and what to prepare allows you to welcome BIR examiners with confidence during your tax mapping process.

If you find the tax mapping process meticulous, you may reach out to tax compliance providers to help you with the tax mapping process in the Philippines.

Confidently Prepare Your Tax Mapping Compliance in the Philippines

With a comprehensive suite of tax and corporate compliance services, our teams of experienced professionals are committed to assisting you in complying with the most recent tax laws and regulations.