BIR Issues Amendments to “De Minimis” Benefits

“De Minimis” are benefits or perks given by employers that are of small value and considered compensation not subject to income tax and, consequently, not subject to withholding tax, nor to fringe benefit tax.

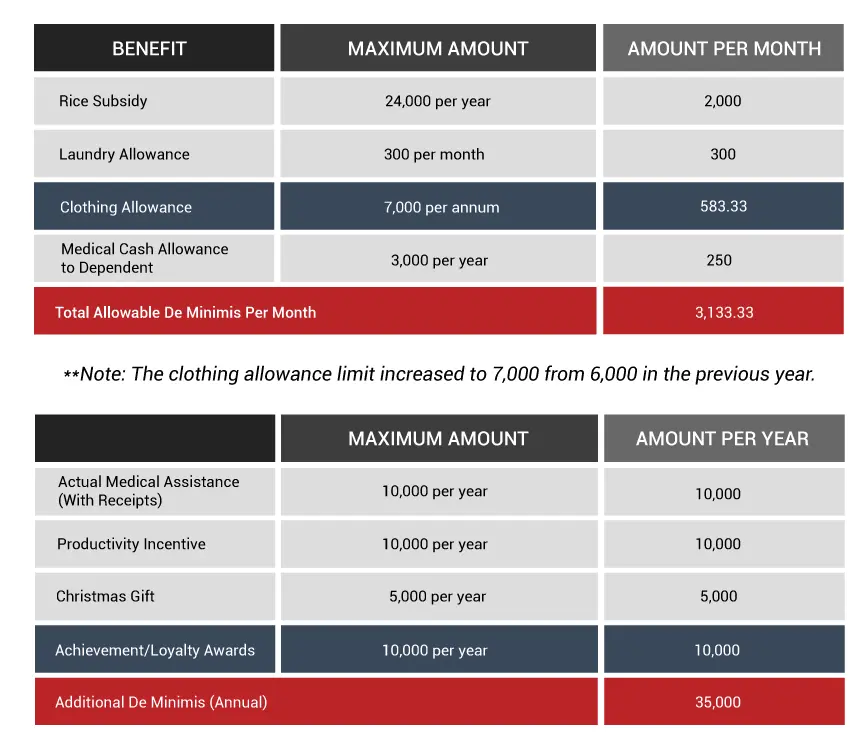

Revenue Regulations No. 004-2025 have introduced further amendments to the De Minimis provisions of Revenue Regulations No. 2-98. Below is a summary of the monetary De Minimis benefits as prescribed under the prevailing tax laws:

**Note The Achievement and Loyalty Awards have been updated from non-monetary to monetary. Previously, such benefits were considered non-taxable only if provided in the form of tangible personal property. However, under the updated provisions for this year, Loyalty and Achievement Awards may now qualify as non-taxable, regardless of whether they are granted in cash, gift certificates, or tangible personal property.

Under RMC 50-2018, it is imperative to note that any De Minimis benefits granted over the prescribed maximum threshold shall be classified under “other benefits” and thereby subject to the Php90,000 statutory ceiling. Any amount exceeding the Php90,000 limit shall be subject to income tax and, consequently, to the withholding tax on compensation.