A Comprehensive Guide to Internal Audit in the Philippines

Internal audit plays a crucial role in modern organizations by providing valuable insights into governance, risk management, internal control processes, and tax compliance. For enterprises operating in the Philippines, a strong internal audit function is not just a best practice but a critical component for sustainable growth and adherence to regulatory and tax compliance requirements.

- What is Internal Audit?

- What are the Common Types of Internal Audits?

- What are the stages of a BIR audit?

- Issuance of Electronic Letter of Authority

- Issuance of Notice of Discrepancy (NOD)

- Issuance of Preliminary Assessment Notice (PAN)

- Issuance Formal Letter of Demand (FLD) / Final Assessment Notice (FAN)

- Frequently Asked Questions

What is Internal Audit?

Internal auditing in the Philippines is fundamental to achieving organizational success and advancing strategic objectives. Through systematic assessments, internal auditors strengthen the reliability of internal controls, daily operations, and governance frameworks.

These services not only strengthen a company’s risk management and compliance with regulatory requirements but also offer assurance that business activities are conducted efficiently and in accordance with ethical standards.

What are the Common Types of Internal Audits?

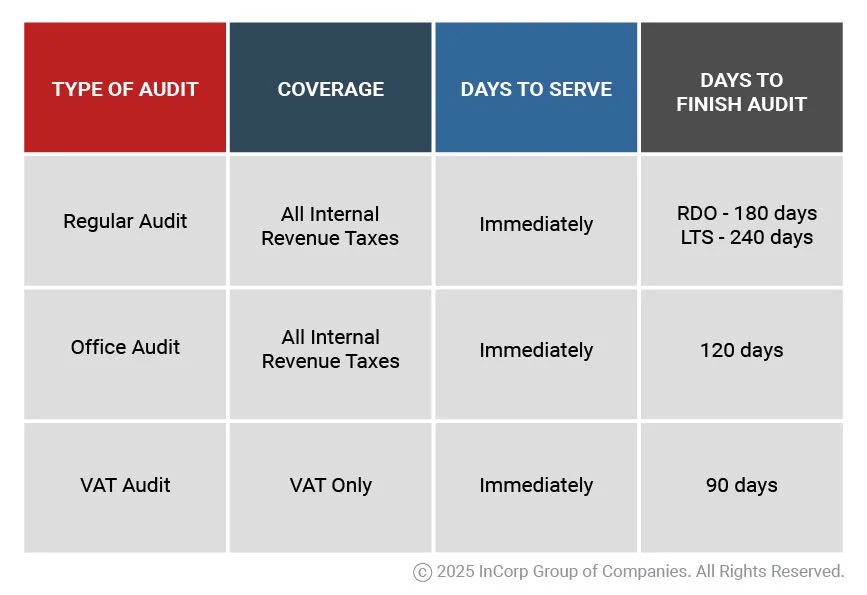

Each audit type has its own coverage and sets a deadline. Below are the common types of Internal Audit:

What are the procedural stages of a BIR audit?

A Bureau of Internal Revenue (BIR) audit generally follows a series of key stages, beginning with the issuance of an electronic Letter of Authority (eLOA), followed by document review, the possible issuance of a Notice of Discrepancy (NOD), and then a Preliminary Assessment Notice (PAN) if necessary. In certain situations, the process moves directly to a Formal Letter of Demand or Final Assessment Notice (FAN).

- Issuance of Electronic Letter of Authority.

The electronic Letter of Authority (eLOA) is an official document authorizing a Revenue Officer to examine a taxpayer’s books of accounts and other accounting records to determine correct tax liabilities. This letter includes a request for various documents, such as tax reports, returns, and accounting records, which are typically listed in an attachment.

- Who Issues the Letter of Authority. The authority to issue an eLOA depends on the taxpayer’s jurisdiction. For those under the National Office, the Commissioner of Internal Revenue issues the eLOA, while for taxpayers under Regional Offices, it is issued by the respective Regional Director.

- Service and Presentation of LOA. The Letter of Authority (LOA) must be served and presented to the taxpayer by the Revenue Officer concerned. As clarified under Revenue Memorandum Circular (RMC) 82-2022, an eLOA remains valid even if it is served beyond this former 30-day timeframe.

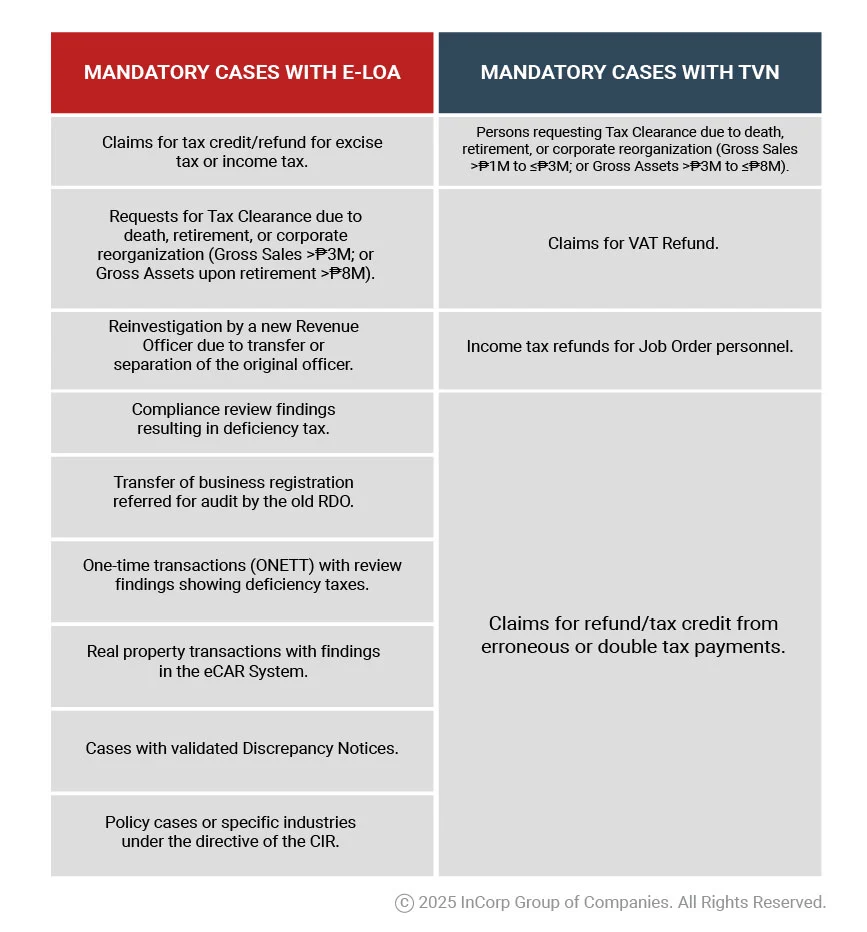

- Who can be subjected to a BIR Audit. While all taxpayers can be considered for an audit, Revenue Memorandum Order (RMO) 6-2023, as amended by RMO Nos. 8-2023, 1-2024, 17-2024 and 36-2025, specifies mandatory cases that require either an electronic Letter of Authority (e-LOA) or a Tax Verification Notice (TVN).

- Issuance of Notice of Discrepancy (NOD)

When an investigation by a Revenue Officer reveals that a taxpayer has a potential tax deficiency, a formal written notification known as a Notice of Discrepancy (NOD) is issued. The primary purpose of the NOD is to provide the taxpayer with an opportunity to respond to and explain their position regarding the identified discrepancies before any formal assessment is made.

- Period to Settle NOD. Within 30 days of receiving a Notice of Discrepancy (NOD), the taxpayer must participate in a Discussion of Discrepancy (DOD). This formal meeting provides the taxpayer with the chance to present their case, address the findings identified by the assigned Revenue Officer, and submit any supporting documents to validate their explanations or arguments.

- Non-Payment Disagreement Process. Following the Discussion of Discrepancy (DOD), if it is determined that the taxpayer remains liable for deficiency taxes despite having had the chance to present their case, a specific process is initiated. This procedure addresses situations where the taxpayer does not resolve the outstanding tax liability after the discussion phase.

- Issuance of Preliminary Assessment Notice (PAN)

A proposed assessment is issued when there is a sufficient basis to hold a taxpayer liable for tax deficiencies. This document must clearly detail the facts, laws, rules, and legal precedents that form the basis for the assessment. Upon receiving the Preliminary Assessment Notice (PAN), the taxpayer has 15 days to submit a reply.

- Exceptions of PAN

A Formal Letter of Demand and Final Assessment Notice (FLD/FAN) is issued immediately under several specific circumstances. These include:

- When a tax deficiency arises from a mathematical error.

- If a difference is found between the tax withheld by an agent and the amount actually remitted.

- In situations involving tax fraud.

- When excise taxes due on excisable products have not been paid.

- If a taxpayer chose to claim a refund or credit for excess withholding tax but then carried over and applied that same amount to the estimated tax liabilities of a future period.

- Issuance Formal Letter of Demand (FLD) / Final Assessment Notice (FAN)

This document serves as a formal demand for the payment of a taxpayer’s tax deficiencies. It must provide a clear and detailed explanation of the assessment, including the specific facts, legal statutes, regulations, and judicial precedents that support it.

- Final Assessment Notice (FAN). A Final Assessment Notice (FAN) is a formal communication from the tax authority demanding payment of a taxpayer’s outstanding tax liabilities. The process generally unfolds as follows:

- Filing a Protest or Request for Reconsideration: If the taxpayer disagrees with the assessment, a written protest or request for reconsideration or reinvestigation must be submitted, typically within 30 days from receipt of the FAN. This protest should be accompanied by relevant supporting documents and arguments challenging the findings.

- Evaluation by the Tax Authority: The tax authority examines the protest; reviews submitted evidence and conducts any necessary clarifications or discussions. Based on its evaluation, the authority may affirm, revise, or cancel the original assessment.

- Resolution and Issuance of Decision: Once a resolution is reached, the taxpayer is formally notified of the decision regarding the protest—whether the assessment is sustained, modified, or withdrawn.

- Finality of Assessment: If the taxpayer fails to lodge a protest within the stipulated period, the FAN becomes final, executory, and demandable. At this point, the tax authority may initiate collection proceedings should the tax liabilities remain unpaid.

Learn More About BIR Tax Audit in the Philippines

Frequently Asked Questions

How often does the BIR conduct audits?

The BIR doesn’t audit taxpayers on a fixed schedule but uses a risk-based selection process. Businesses may be audited due to discrepancies in tax filings, consecutive losses, industry scrutiny, or random selection. While some may never face an audit, large corporations are audited more often. An audit officially begins with a formal Letter of Authority (LOA) from the BIR.

What triggers a BIR audit?

A BIR audit may be triggered by tax inconsistencies, unfiled reports, large transactions, frequent amendments, consecutive losses, targeted sectors, tips, or random selection.

How long does a BIR audit typically take?

A BIR audit’s duration depends on business complexity and review scope. It typically lasts months from the Letter of Authority to resolution but can extend beyond a year for complex or disputed cases.