RR 029-2025: Amended De Minimis Benefits

The Bureau of Internal Revenue (BIR) has recently issued Revenue Regulation (RR) No. 029-2025. This regulation further amends the provisions concerning “De Minimis” benefits, clarifying their treatment within payroll processes, as these benefits remain exempt from income tax and fringe benefit tax.

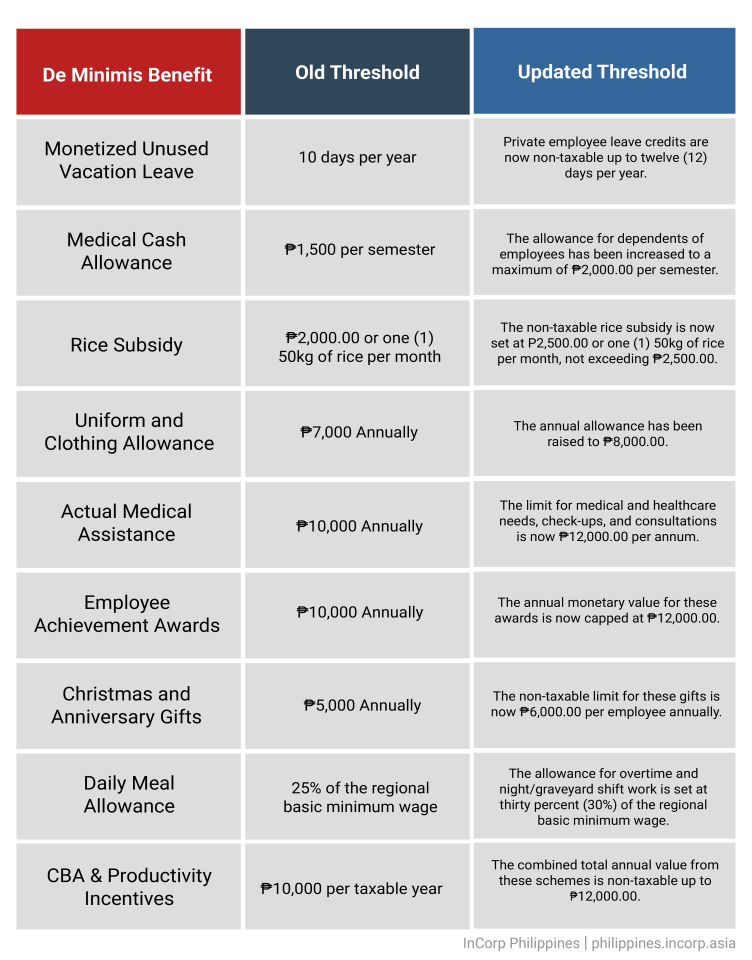

The key amendments introduced in RR No. 029-2025 include increased ceilings for several non-taxable benefits to better reflect current economic conditions. Notable changes include:

These regulations will take effect on January 6, 2025.

To ensure compliance, all organizations should promptly review and update their compensation and benefits structures. It is essential to adjust payroll systems and internal policies to apply the new tax-exempt thresholds accurately.