SEC Extends ECIP Application for Non-Compliant Corporations

The Securities and Exchange Commission (SEC) extends an opportunity for non-compliant, delinquent, suspended, and revoked corporations to settle fines and penalties at reduced rates for the late or missed submission of Annual Financial Statements (AFS), General Information Sheets (GIS), and MC28 compliance. This program is available until the extended deadline of December 31, 2024.

Beginning January 1, 2025, the SEC will enforce higher penalties for the late or missed submission of reportorial requirements. Corporations are advised to comply promptly to avoid these increased fines.

Eligible Corporations

Those corporations eligible for the Enhanced Compliance Incentive Plan include the following Stock and Nonstock Corporations:

- Branch Office

- Representative Office

- Regional Headquarters

- Regional Operating Headquarters of Foreign Company

Exceptions:

Companies whose securities are listed on the Philippine Stock Exchange (PSE);

- whose securities are registered but not listed on the PSE;

- considered as public companies;

- with intra-corporate disputes;

- with disputed GIS;

- with expired corporate terms and

- covered under Section 17.2 of Republic Act 8799 or the Securities Regulation Code

Covered Violations

The following are the violations covered by the Enhanced Compliance Initiative Program:

- Non-filing of the General Information Sheet (GIS) for the latest and prior years;

- Late filing of GIS for the latest and prior years;

- Non-filing of Financial Statements (AFS), whether audited or certified, including fines for the non-filing of the attachments required for certain corporations for the latest and prior years and

- Late filing of AFS, including fines for the late filing of the attachments required for certain corporations for the latest and prior years

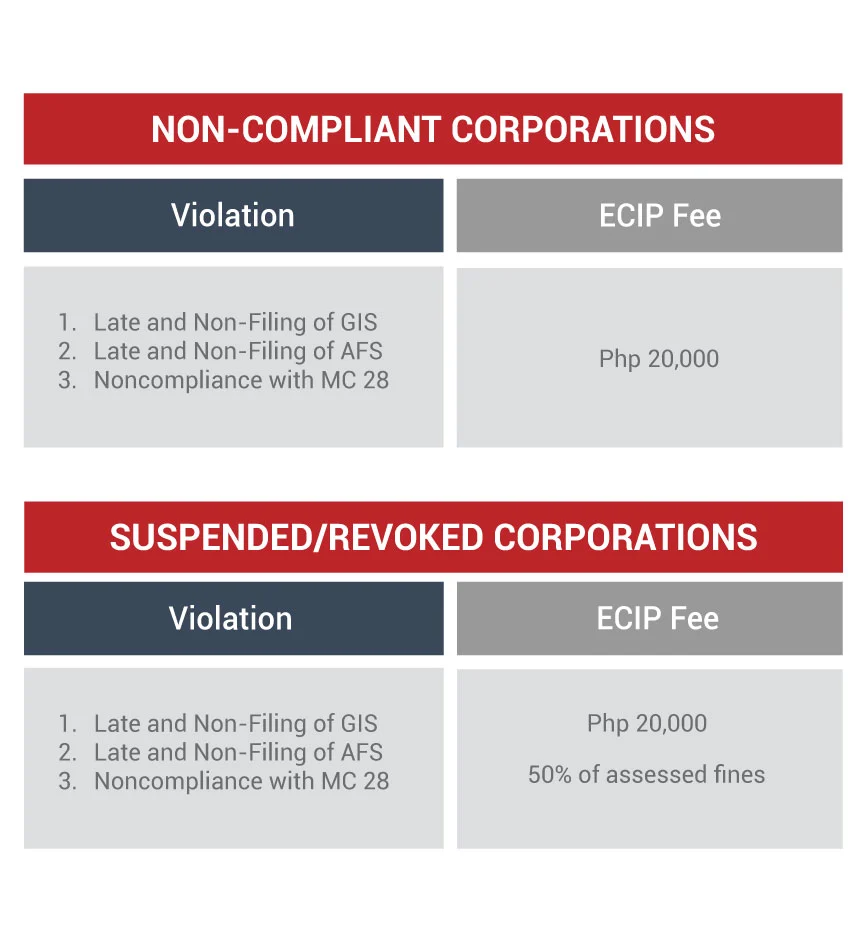

Penalty Fees

The following outlines the reduced penalties applicable to non-compliant, suspended, and revoked corporations: